In the case of an individual the miscellaneous itemized deductions for any taxable year shall be allowed only to the extent that the aggregate of such deductions exceeds 2 percent of adjusted gross income.

Miscellaneous itemized deductions floor.

You can still claim certain expenses as itemized deductions on schedule a form 1040 1040 sr or 1040 nr or as an adjustment to income on form 1040 or 1040 sr.

As of the 2018 tax year itemized deductions for job related expenses or other miscellaneous expenses outlined below that exceeded 2 of your income have been suspended.

Your standard deduction is a fixed amount you can deduct based on your tax return filing status.

Starting on january 1 2018 and running through december 31 2026 individuals will no longer have the ability to deduct the excess expenses listed below as itemized deductions on their 1040s.

These include the following deductions.

All deductions for expenses incurred in carrying out wagering transactions and not just gambling losses are limited to the extent of gambling.

Tcja the new tax code suspended investment fees and expenses along with all other miscellaneous itemized deductions subject to the 2 floor.

Specifically the tcja suspended for 2018 through 2025 a large group of deductions lumped together in a category called miscellaneous itemized deductions that were deductible to the extent they exceeded 2 of a taxpayer s adjusted gross income.

With respect to individuals section 67 disallows deductions for miscellaneous itemized deductions as defined in paragraph b of this section in computing taxable income i e so called below the line deductions to the extent that such otherwise allowable deductions do not exceed 2 percent of the individual s adjusted gross.

Deductible expenses subject to the 2 floor includes.

Miscellaneous itemized deductions.

This publication covers the following topics.

Job expenses and certain miscellaneous itemized deductions.

Unreimbursed employee business expenses such as.

These are work related.

Expenses that exceed 2 of your federal agi.

2 percent floor on miscellaneous itemized deductions.

Gambling losses are deductible to the extent of gambling winnings.

Two itemized deductions for investors survived tax.

Expenses for uniforms and special clothing.

Prev next a general rule.

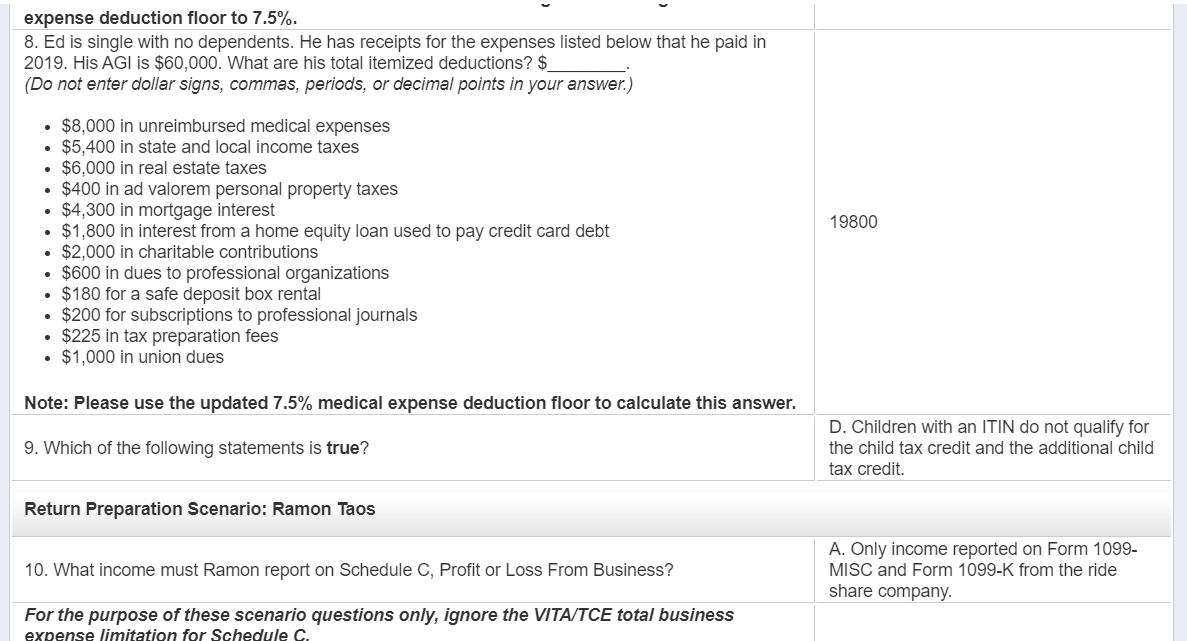

For tax years previous to 2018 if you itemize your deductions part of the expenses that you claim as deductions may be limited by the 2 rule deductions that are included are unreimbursed employee expenses expenses.

A type of expenses subject to the floor 1 in general.